Credit monitoring lets you stay on top of your credit history and other financial behaviors (including when you apply for new loans), get new credit cards, or make transactions using them. In other words, if you use a credit monitoring service for your Credit card payments, you can see any unusual activity and stop it before the situation goes out of your hands.

As a bonus, you may use credit monitoring featBe vigilant against deception:ures to track your credit-related actions and score. By doing this, you can predict whether you’ll be able to apply for a loan or a new credit card and Credit card rewards. Learn more about why you need to monitor your credit report consistently by reading on.

By monitoring your credit report, you can identify any early signs of fraud or identity theft. A credit report might alert you to potential problems if you notice a strange address, credit accounts you didn’t apply for, or activity on credit cards you haven’t used recently. Similar to a physical, spotting an issue early helps stop it from getting worse.

Identify the inaccuracies in your Credit card management:

The bureaus can receive an incorrect report from one of your creditors. As an illustration, your credit card provider can inadvertently claim that your account was not paid. You’d want to know immediately so that you can make things right because this could have a bad impact on your credit health.

Find and challenge errors

Not all mistakes imply fraud. Your credit can be seriously harmed by Bill payments that were incorrectly recorded as late by a lender. If the mark was incorrectly registered, you could dispute it with your lender or the credit reporting company to remove it from your credit report.

You may also come across data that results from a typo, like when a creditor provides an inaccurate SSN or an address in the wrong place. An incorrect SSN or other personal information can be disputed, and removal requests can be made. The genuine SSN never reflects on the Credit score report to safeguard you from fraudulent activity.

Monitoring changes in credit history

A credit record also fluctuates when accounts start and close or balances increase and decrease. These modifications may occur from one day to the next based on your account’s activity! You can keep track of these updates and always be aware of your position by monitoring your credit.

Avoid Identity Theft:

By carefully monitoring your credit history, you can identify any errors and possibly stop yourself from falling victim to phishing scams. Such discrepancies can lower your credit history significantly and, consequently, your creditworthiness if they go unreported for an extended period. If you notice any such irregularities, file a complaint with the credit bureau or notify the respective banks.

Customized Alerts:

If you want to use credit monitoring services, you may set up alerts for various things, such as suspicious fraudulent activities and changes in your credit report. As a result, you will constantly be aware of your ability to get a loan or credit card in the long run.

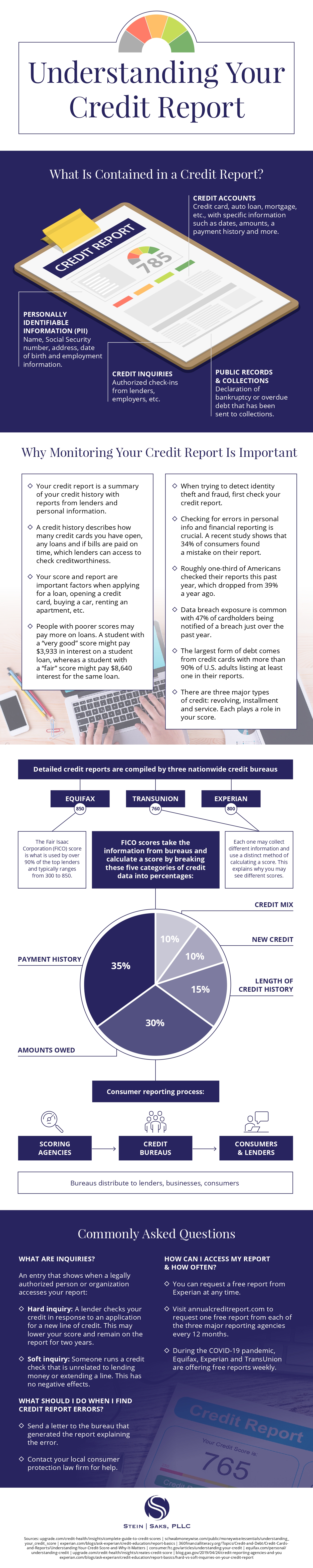

This infographic was created by Stein Saks, learn more about credit reporting errors

More Stories

Tax Return and How to Handle It Professionally

The importance of timely payroll processing for employee satisfaction

Sales and Use Tax Compliance Consulting: A Key Service for Businesses